With every invoice a company receives, there is an associated cost that comes along with it. The cost of reviewing, processing, and paying the invoice. Now while this particular cost may not be all monetary, there is a cost that comes with the substantial amount of time it takes to handle such a task.

When comparing the speed, efficiency, and cost of invoicing using automation to invoicing manually, there is no comparison. Invoice automation saves companies time and money, but also keeps vendors happy and reduces the workload on its employees. Having an ERP system in place, like NetSuite, will make invoice automation an easy task that will help ramp up the performance of the company.

Invoice Automation Explained

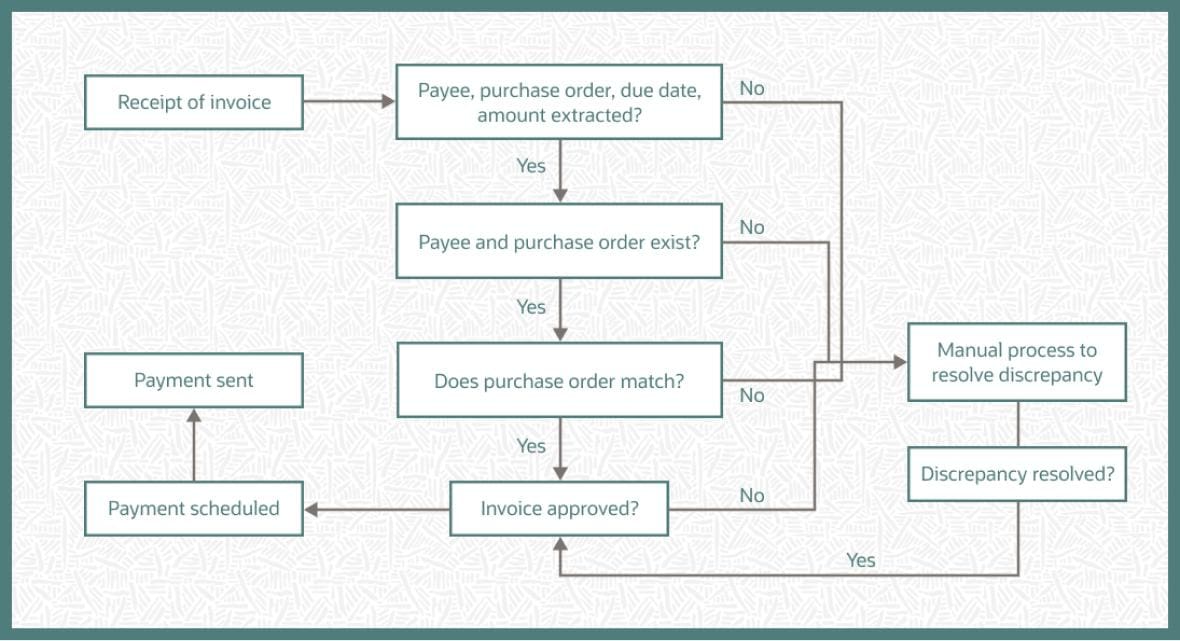

Utilizing a series of "if this, then that" rules within a specific workflow, an automated invoicing system receives an invoice and automatically manages to process it. When an inbound invoice is received, the software picks off certain bits of information from it and then decides what the next step will be. Information like purchase order numbers can be referenced within a business's database to confirm the accuracy and then the invoice continues down the pipeline.

Invoice automation is basically a workflow that has multiple steps of processing that ultimately lead to payment.

The Steps of Invoice Automation

Manual processes plague businesses all over the world with their inefficient processes, delays, and challenges they create for Accounts Payable (AP) staff. Automation can address these pain points and improve productivity, cost savings, and more, immediately. Most workflows for invoice automation typically include the following steps:

- Invoice Received. The invoice arrives from the vendor, either digitally or in paper form. Paper invoices must be scanned in manually, while digital invoices will populate into the software with ease.

- Invoice Recorded. The data from the invoice is then entered into the accounting system and recorded in the AP general ledger as a credit.

- Data Verification. The system then moves on with verifying the data that it extracts from the invoice. It confirms things such as the payee is in the system and the purchase order number matches the original.

- Data Confirmed. The system then uses two-way matching to match the invoice information to the purchase order information on file.

- Invoice Approval. If everything checks out up to this point, the vendor invoice is automatically approved for payment. If there is a discrepancy in pricing or other data, the system requires human attention to review.

- Payment Scheduling. Referencing the due date or terms listed on the invoice, the system automatically schedules the required payment. This is where something like an early-pay discount would be picked up by the system as well.

- Invoice Paid. The workflow is now complete and the payment is issued to the vendor. The invoice is settled and is then moved from the AP general ledger account as a debit and added as a credit in the company's cash account.

Source: NetSuite

Source: NetSuite

Why Should a Business Use Invoice Automation?

Invoice automation will provide a business with a host of benefits that will relieve the accounting team of handling AP processes manually. Some of the most common benefits are:

Improved accuracy. Removing the risk of human error and manually entered data.

Reducing Costs. The time and money that it takes to manually enter invoices are restored.

Faster Processes. There is less of a delay from when invoices are received to when they are processed.

Increased Productivity. Handle more with less. Free up staff for larger projects.

Better Cash Flow Management. Accurate cash flow levels help a company get an accurate look at its health.

Safer Processes. Catching invoicing mistakes and fraud attempts is much easier and more accurate.

Improve Vendor Relationships. Vendors like to be paid on time, now there is no doubt.

Take It Up a Notch

While automation may be new for some business owners, there is always the option of turning to an outsourced bookkeeping service provider like AccountingDepartment.com. By making the switch to outsourcing, business owners can leverage the skills of a trained accounting specialist to handle the books and utilize systems like NetSuite to open up a host of additional benefits. Reach out to AccountingDepartment.com today to learn more and see how we can help.